Cyber criminals are increasingly targeting student financial aid through phishing scams and fraudulent schemes. With financial aid being a critical resource for many students, cybersecurity officials stress the importance of awareness and precautionary measures.

Phishing emails, imposter login pages and fraudulent job postings are among the primary tactics used to steal student credentials, according to Ian Fleming, chief information security officer.

“We train employees on this and the most common threat we see is from phishing emails,” Fleming said. “You get a link, and it looks urgent—like your financial aid is going to be canceled. You click, and it looks like a Microsoft sign-in page. If you’re not paying attention to the URL, they’ve got you.”

Once scammers obtain login credentials, they can access student accounts, steal financial aid funds, send spam emails or even launch ransomware attacks against the institution.

According to Chief Information Security Officer at the Board of Regents of the University System of Georgia Todd Watson, the decision to address this issue across the university system arose after multiple cases of students falling victim to fraud.

“Students may receive an email or a social media message claiming they can get a discount on their student loans,” Watson explained. “The message prompts them to enter their university credentials to validate their identity. Once the student enters their username and password, the threat actor gains access to their actual accounts, including banking details linked to student loans.”

Watson emphasized that cyber criminals craft emails and messages that appear official, often featuring the Department of Education logo or familiar university branding.

“Students think, just because an email has the Department of Education logo, that it’s legitimate. But a closer look at the sender’s email address often reveals it has nothing to do with the Department of Education. A little scrutiny can prevent falling into these traps,” he said.

The scam is usually discovered only after a student realizes their expected funds never arrived.

“Each institution has its own system for handling financial aid, but generally, students set up an account for direct deposits. If a criminal gains access, they can change the student’s banking information, causing their financial aid money to be deposited into the fraudster’s account,” Watson said.

Many students wonder how cyber criminals manage to mimic official university communications so well. Watson attributes this to the sheer volume of university emails circulating worldwide.

“With 360,000 students in the university system today and decades of email usage, criminals can easily observe the patterns of institutional email addresses,” Watson explained.

Watson emphasized that vigilance and critical thinking are the best defenses against social engineering tactics used by cyber criminals.

“These criminals’ job is to separate you from your money, and they do it very well,” he said. “Pausing to critically assess a message before responding can save students from financial loss and stress.”

Generative AI tools, such as ChatGPT and Copilot, have made it easier for scammers to create sophisticated phishing pages and malicious content, Fleming said.

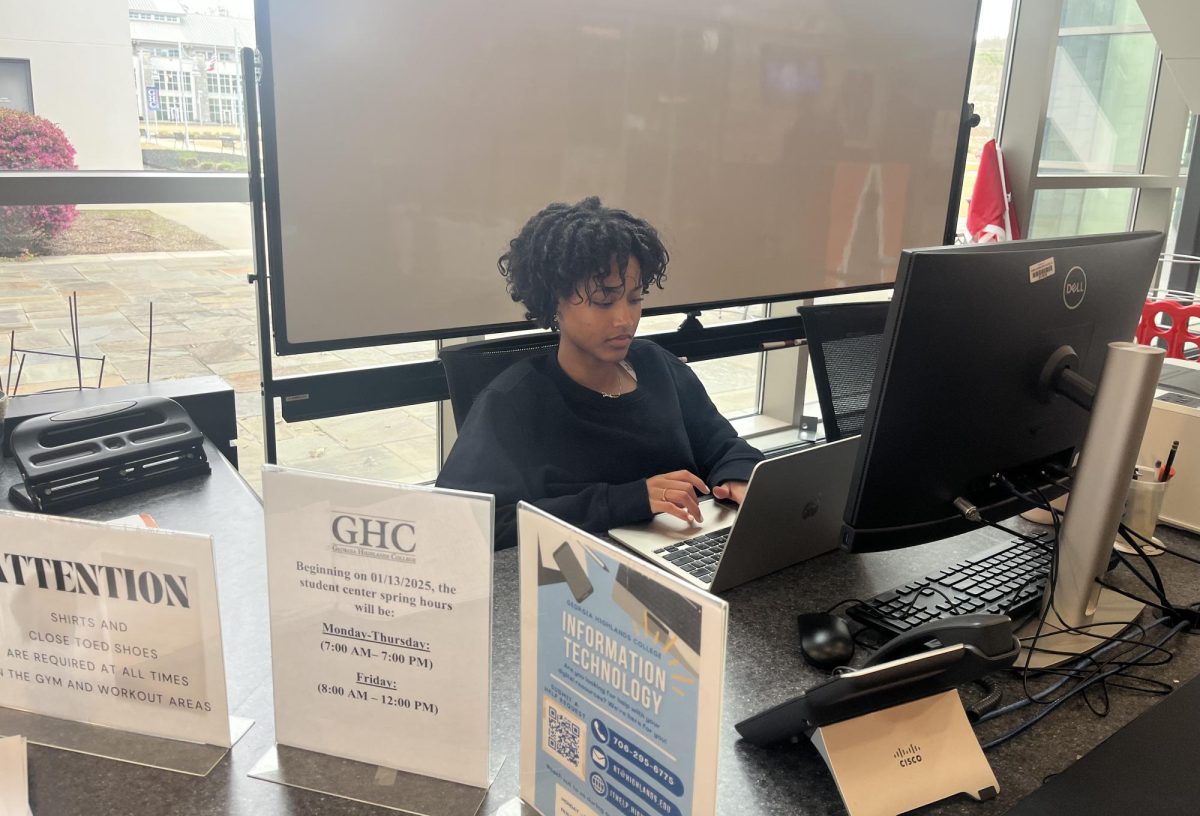

GHC has implemented security protocols to detect and prevent unauthorized access to student accounts. The college provides phishing awareness training and encourages students to report suspicious emails.

“We have a phishing alert button that lets us scan attachments to see if they contain malware,” Fleming said. “That’s a crucial tool for stopping cyber threats before they spread.”

If students encounter suspicious activity, they should report it to the IT team at infosec@highlands.edu or submit a request through the IT ticketing system at rt@highlands.edu. Online students can also seek assistance through the student help desk.