Reddit-fueled “short squeeze” leaves GameStop short-sighted

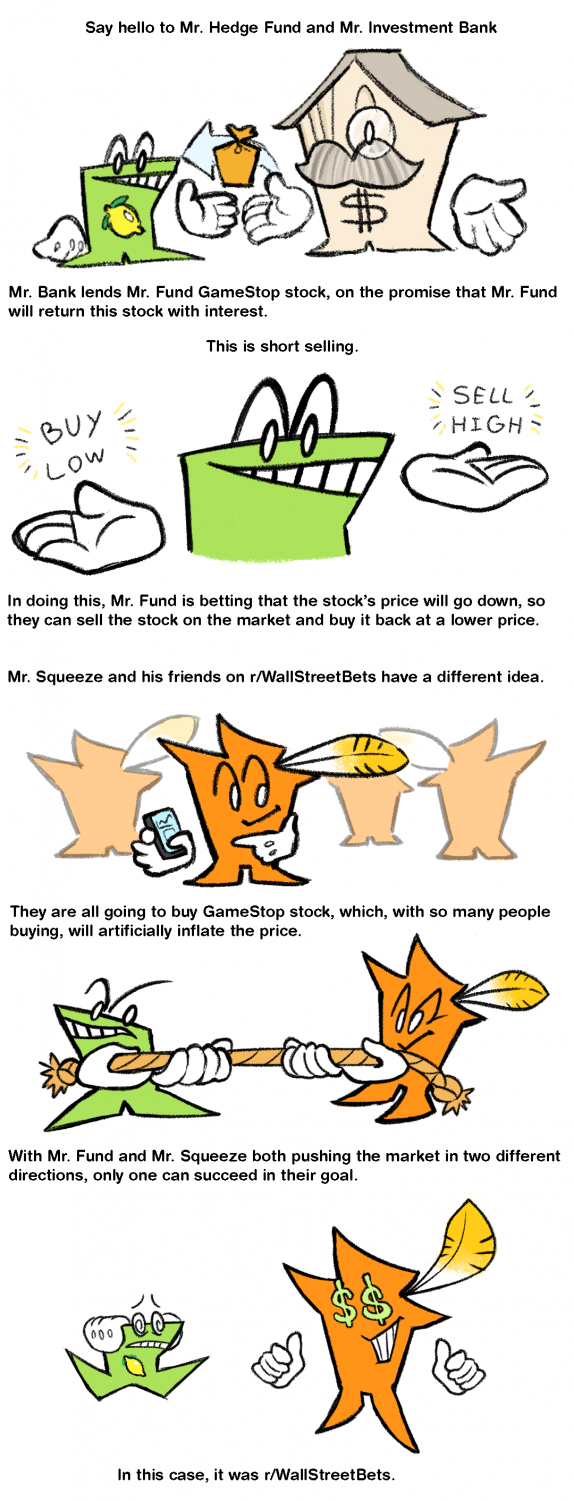

In the closing days of January, the price of GameStop stocks rose 1,700% in a historically massive spike known as a “short squeeze.” The event was initiated by the conflicting interests of certain hedge funds and millions of individual investors from reddit, spawning countless memes and endless confusion for those of us unfamiliar with the stock market.

What is a hedge fund?

A hedge fund is an investment fund open to a limited number of accredited investors, which are usually wealthy individuals. Hedge funds are known for their relatively lax regulation, risky investments and use of leverage — borrowed money.

Who are these redditors?

r/WallStreetBets is a reddit community dedicated to investing in the stock market. The community has over 8 million subscribers and describes itself as “Like 4chan found a bloomberg terminal.” It’s known for its edgy humor, risky investments and “meme stocks” — stocks of companies whose valuation success is rooted in meme culture.

What does GameStop have to do with this?

GameStop is a “meme stock.” When redditors caught wind that hedge funds Melvin Capital and Citron Research were short selling — or betting against — GameStop stock, they took to brokerages, such as Robinhood, to buy stock en masse. This drove up GameStop’s market value and meant big losses for the hedge funds and massive gains for certain investors.

short squeeze. Illustration by Russell Chesnut.

On Jan. 28, in response to GameStop’s highly volatile market, Robinhood took the risky decision of freezing purchases of GameStop stock. This came to the upset of investors, lawmakers and even Tesla CEO Elon Musk, a long-time critic of short sellers.

GameStop’s stocks have since collapsed and remain on a decline. Despite recent buzz that Chewy founder Ryan Cohen, who owns 13% stake in GameStop, could lead a resurgence of the company, it doesn’t look like GameStop will be skyrocketing to record highs again anytime soon.