Student loan forgiveness: A step in the right direction

U.S. President Joe Biden’s federal student loan forgiveness plan will forgive $10,000 or $20,000 depending on legal factors such as marital status and taxes filed. Some say the forgiveness amount is not enough and others say that it’s a slap in the face to those who had to pay off all their student loans.

October 10, 2022

President Joe Biden believes he has found the solution to the woes of American students who are laboring under the weight of student loan debt. His three-step plan is a step in the right direction but only sees a small corner of a larger picture.

The ever-increasing costs of secondary education have many students scrambling to meet these needs.

According to the U.S. Department of Education website, federal grants once covered almost 80 percent of costs. However, due to a failure in government oversight, that is no longer the case.

In consequence, the typical American student graduates with over $25,000 in debt. Even worse are the students that still incur debt but never attain a degree.

In this dog-eat-dog economy that we as Americans live under, the idea of loan forgiveness is not popular in some quarters.

“If you can’t afford college, you shouldn’t go” is a common refrain these days. This very oversimplified and shortsighted viewpoint is inspired by the perceived cost to taxpayers.

However, this country is currently suffering from a dire shortage of medical staff, educators and mental health practitioners.

Manufacturing and industrial jobs are disappearing rapidly. An already grim picture in these areas would be painted even darker if those who sought a college degree surrendered to defeat because of cost.

On the other side are those who feel that the cancellation of student loan debt is to be praised as a very good thing.

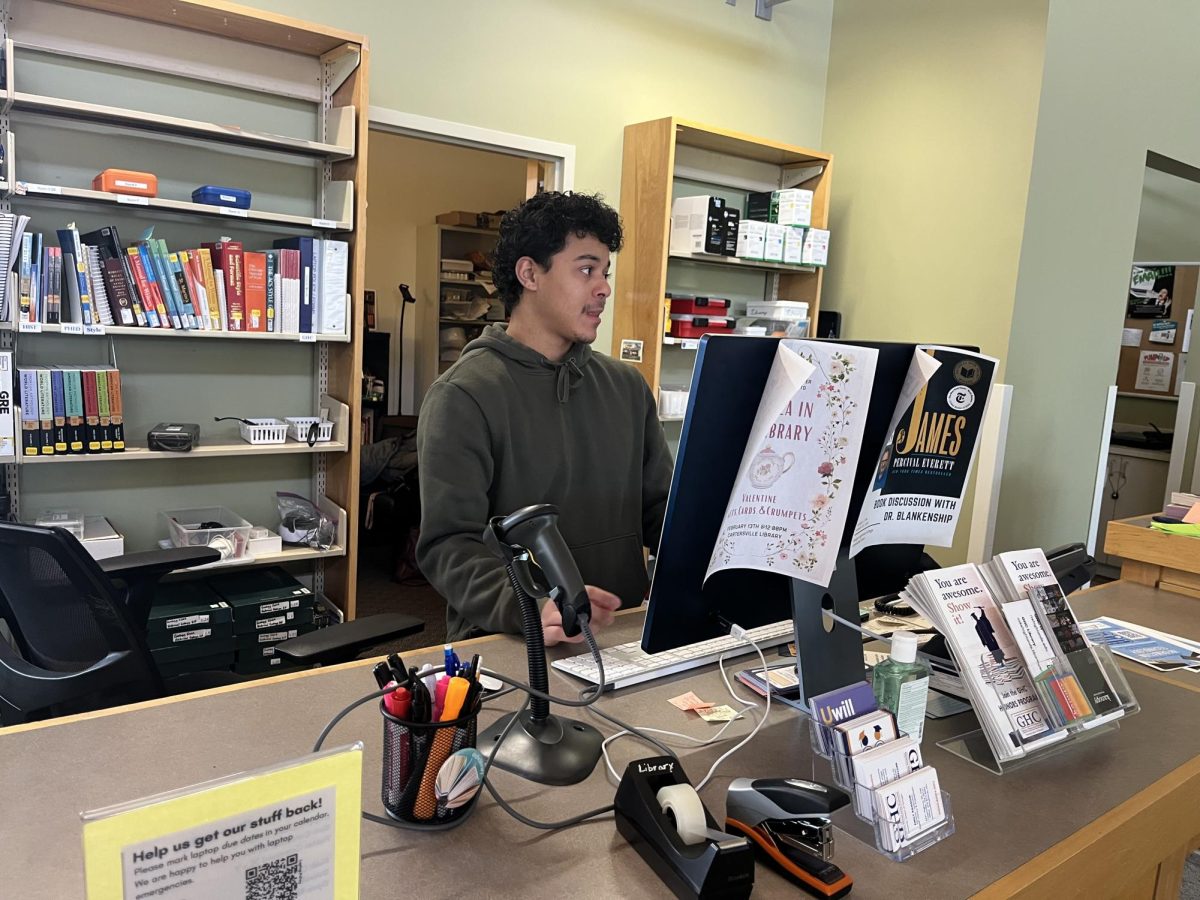

As Georgia Highlands College Financial Aid Counselor Ana Kind said, “This is going to help a lot of people not be burdened by loan payments after graduation.”

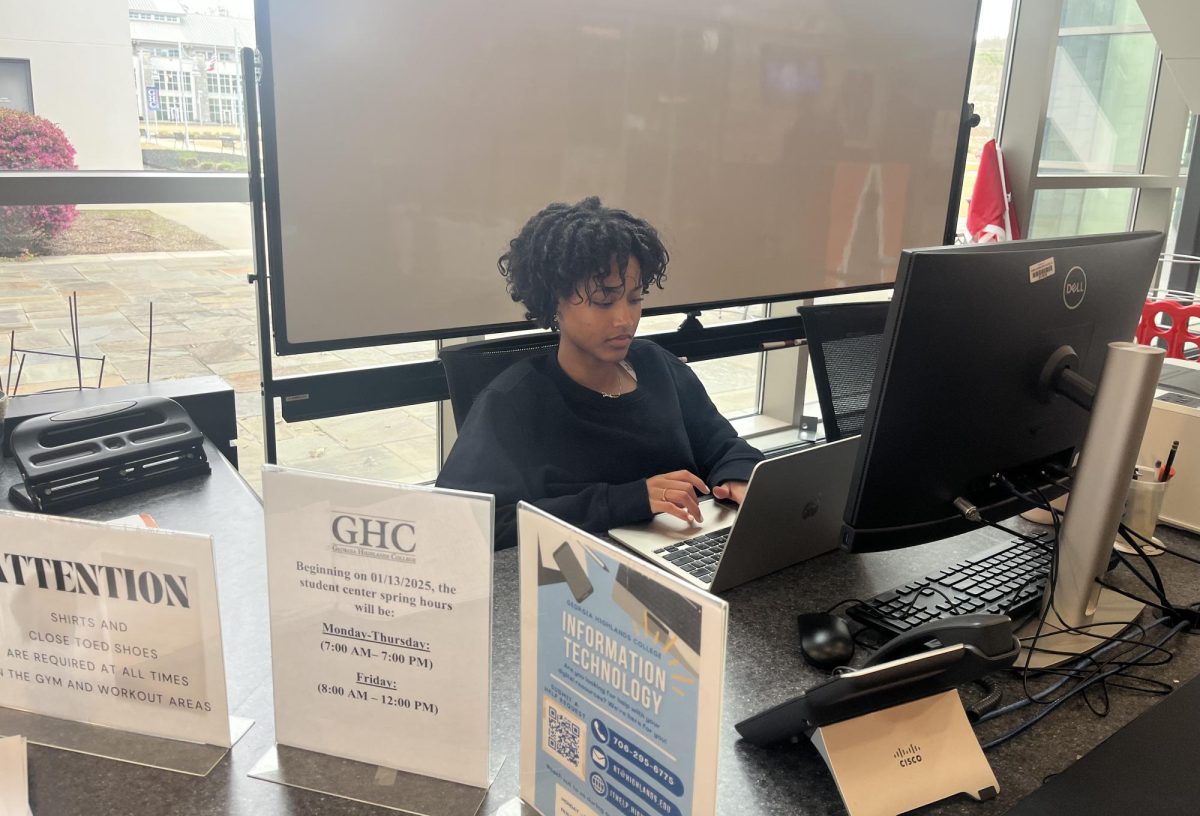

Billy Velasquez, a student at GHC, agrees. “I have a student loan and I will be applying for student loan forgiveness to keep my debt down,” he said.

Others believe that education should be encouraged due to the correlation between an educated populace and quality-of-life ratios. The higher the education ratio a society has the fewer social problems such as poverty, crime, bigotry and inequality exist within it.

Students who pay out of pocket or former students who have already paid off their loans have mixed emotions concerning Biden’s plan. Many believe it unfair, while many approve.

Ray Muther, a student at GHC, said: “Though I pay out of pocket, I like the idea of loan forgiveness. I think it’s a good thing to help students.”

Though President Biden’s plan focuses largely on student loan debt and the nation’s attention is centered on that one aspect, the plan has two additional steps.

The third step, though lacking in detail, is important due to its proposal to hold colleges accountable for rate hikes.

Objectors to Biden’s plan as defective in the long run are correct. Debt forgiveness cannot go on forever. Why should it have to? Students would have a better chance of not finding themselves in debt if the cost of secondary education was affordable.

Institutions of higher learning should be held accountable for increases in price and responsible for reducing costs where possible.

Eliminating added costs such as athletic fees for students who do not participate in sports, and hefty technology fees are among the efforts that could be made to ensure that a college education is more affordable.