The OWS movement has been going strong now for over a month, but does it have staying power and is there a main focus?

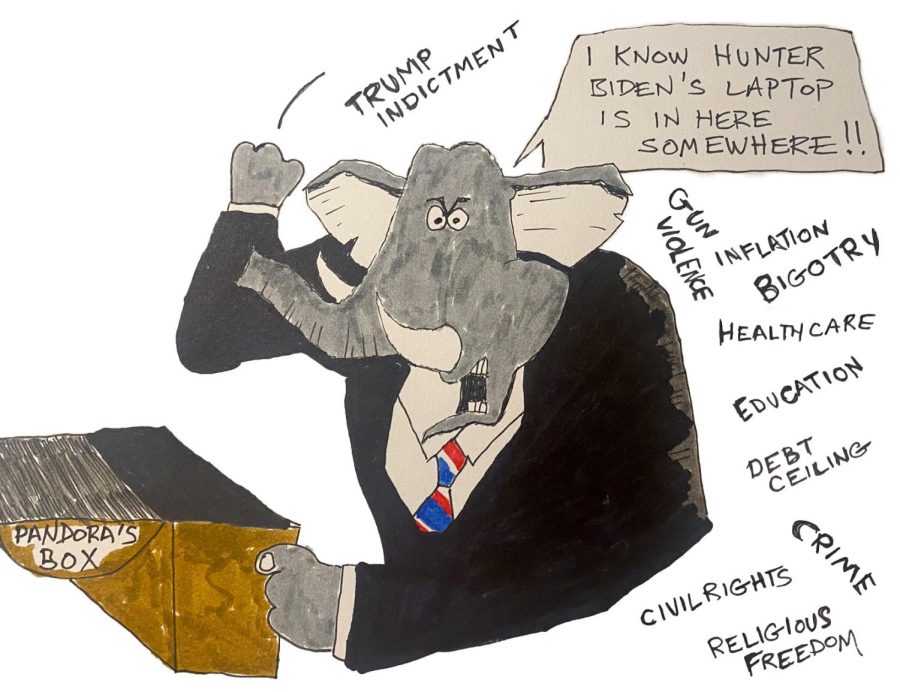

I do understand that Wall Street is a place where corruption thrives. The thing I have a hard time understanding is why Americans are so quick to protest the banks when indeed it is not just the banks’ fault. It’s also the government’s. For it is true that our government handed billions of dollars to the banks in 2008.

I am glad to see that my fellow young Americans are standing up and exercising the rights they were given in the Constitution, but let us not forget that our government just decided to hand Wall Street CEOs billions during the bail out. Washington has become a revolving door for Wall Street officials. As long as Wall Street’s CEOs can slip out the back door, so to speak, into Washington, the problem will not be solved. Once officials are in Washington, in many cases they can just vote themselves raises, if they all agree.

Many of the new restrictions that Washington has imposed on the banks in turn only further the economic crises. In the case of the housing markets, buyers have now been slapped with stricter screening processes to supposedly eliminate the possibility of someone who cannot possibly pay back the mortgage slipping through the cracks.

For instance, on personal loans as well as mortgage loans, signees cannot list any other income, other than their hourly wage. This action is going to devastate areas of the economic populace who are in the service industry.

In some instances employees of the service industry make less than minimum wage hourly; this may possibly disqualify them now for a home loan or, in the case of yours truly, a debt consolidation loan. This brings up a very good question.

Is more restriction the answer? I am afraid that the more the government becomes involved with the banks, the more the restrictions that are imposed will be passed down to the little guy.

Indeed, the Federal Reserve announced last week that they will be backing the derivatives of Bank of America. Derivatives are bets that the banks hedge against their loans to protect themselves from failed investments.

So basically every time someone defaults on a loan with Bank of America’s supporting derivatives, the taxpayer will be paying the bill through inflation because the Federal Reserve will just order the printing of more money to offset the loss. This creates a vicious cycle in which the banks can virtually bankrupt someone and then taxpayer covers the bill. We cannot forget that the banks have been allowed to scam us by our own government.

So I say to all the citizens, “If they kick you off of Wall Street, just move to the White House lawn. There’s more room over there anyway!”